Beginning Python Quant Developer – Inverse Floater

Quant Developer, we look at constructing, pricing and reporting on Inverse Floater derivatives in Python using opengamma strata.

We, at poc-d, have taken opengamma‘s strata library (which has been developed in java) and extended it for online learning of capital market products for C#, VB.Net, C++, Python, Java and Scala developers as well an Microsoft Excel addin for financial analysts.

The learning is hands on, which means you will be provided a copy of the library to follow along.

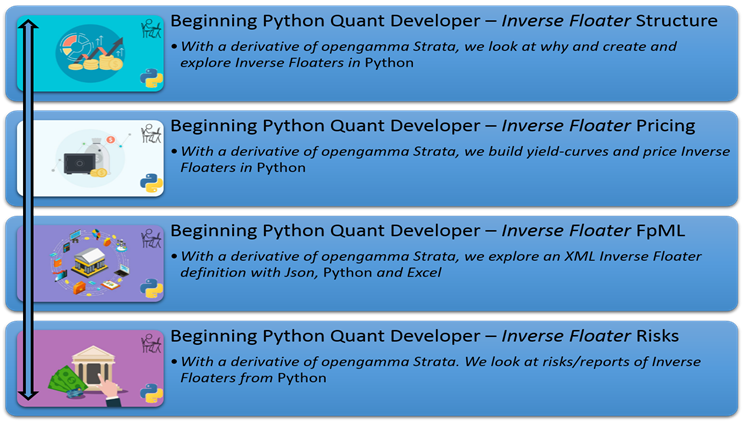

Course Curriculum

- Module #1 : Inverse Floater Structure

- xxx

- xxx

- xxx

- Module #2 : Inverse Floater Pricing

- xxx

- xxx

- xxx

- Module #3 : Inverse Floater FpML

- xxx

- xxx

- xxx

- xxx

- Module #4 : Inverse Floater Risks

- xxx

- xxx

- xxx

- Provided (for hands on)

- Microsoft Excel Addin which exposes required opengamma strata financial functions within Excel

- .NET assembly in which to write capital market code against

- Required

- Minimum Microsoft Windows 7

- 4GB of RAM (8GB preferred)

- Visual Studio 2010 onwards for .NET Development (You can install the free version of Visual studio 2015 community)

- Optional : Microsoft Excel 2007 onwards

Course Access

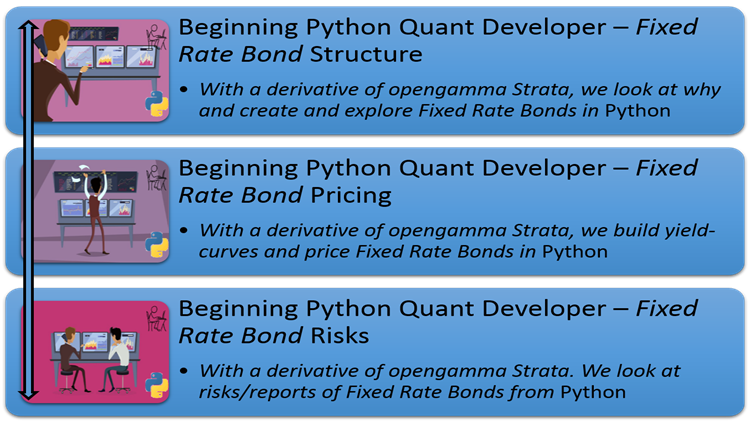

This course is broken down into modules (as seen in the graphic above).

You can access all the Capital Market courses based on C#, VB.Net, C++, Python, Java, Scala and Microsoft Excel for one low monthly fee. Currently the membership site houses courses that covers Fixed Rate Bonds, Swaps, Inverse Floaters, Swaptions and Cap/Floors.

- POC-d membership site : POC-D Membership site

Or each module can be purchased individually from

- Udemy : POC-D Udemy Individual modules

Inverse Floater Derivative

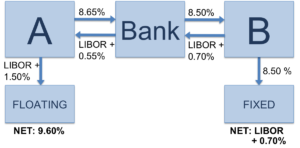

An inverse floating rate note, or simply an inverse floater, is a type of bond or other type of debt instrument used in finance whose coupon rate has an inverse relationship to short-term interest rates (or its reference rate). With an inverse floater, as interest rates rise the coupon rate falls.[1] The basic structure is the same as an ordinary floating rate note except for the direction in which the coupon rate is adjusted. These two structures are often used in concert.

As short-term interest rates fall, both the market price and the yield of the inverse floater increase. This link often magnifies the fluctuation in the bond’s price. However, in the opposite situation, when short-term interest rates rise, the value of the bond can drop significantly, and holders of this type of instrument may end up with a security that pays little interest and for which the market will pay very little.

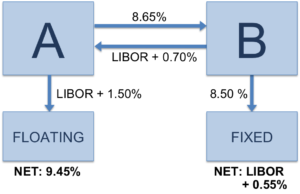

Creation

An inverse floating rate note can be created two ways. The first is by placing an existing or newly underwritten fixed-rate security into a trust and issuing both a floating rate note and an inverse floating rate note. The second method is for an investment banking firm to underwrite a fixed-rate security and then enter into an interest rate swap that has a maturity less than the bond’s term. The investor would then own an inverse floater until the swap agreement expires. When creating an inverse floater through the swap market the need to sell in inverse floaters through a Dutch auction is eliminated. In the first scenario the original security placed in trust is referred to as the collateral, from this collateral both the floater and inverse floater are created.[3] The dealer will split up the underlying fixed-rate asset at a specified ratio (e.g. 20/80) and assign each portion to inverse and floater.

The reference rate and the frequency at which the rate is reset are contractually set. The rate used is often some form of LIBOR, but it can take different forms, such as tying it to the consumer price index, a housing price index, or an unemployment rate. The rate can be allowed to reset on an immediate, daily, or some type of monthly or yearly schedule. The rate can be computed by taking its set stated rate and subtracting the reference rate at the reset date. Caps and floors are often placed within inverse floaters to avoid unattractive features to investors (such as a negative coupon). Typically, the floor is set at zero and a cap may be set (e.g. 10%). If a floater is involved a cap is put on the floater to match up with the inverse’s floor, and vice versa. This is done since both are derived from the same fixed-rate asset.

Inverse floaters are issued in the collateralized mortgage obligation (CMO), municipal, and corporate markets.

The text below is an edited version taken from the strata web site : http://strata.opengamma.io/introduction/

Introduction to Strata for the Quant Developer

What is Strata?

Strata is the award-winning open source analytics and market risk library from OpenGamma.

Strata allows quant developers to build or enhance existing applications with standardized, off-the-shelf market risk components. It includes:

- Pricing, financial analytics and curve calibration

- Reporting

- Scenario evaluation

- Trade modelling

- Market data representation

- Financial foundations – currencies, indices, holidays, date adjustments, schedules, time-series

Strata has been built from the ground up to be lightweight and flexible. It does not impose any database, server or middleware requirements; these would be built on top of Strata. It provides a high-quality, open source Java toolkit that is designed to be used both in its entirety, as well as for its individual components.

Who is Strata for?

Firms have long employed expensive resources – quants and quant developers – to build and maintain market risk functionality that offers no real competitive advantage. Where possible, they wish to leverage existing investments in systems and other in-house technologies, while looking externally for just the components required to fill their solution gaps.

Is there an alternative?

One alternative to building in-house is to look towards out-of-the-box offerings provided by financial software vendors. While these vendors offer solutions to industry business issues, the downside is that many firms have been burned by opaque, closed source vendor models, including vendor lock-in to make or support any changes, and “sledgehammer to crack a nut” software footprints.

Solution

Strata delivers the best of both worlds – industry standard market risk functionality, distributed as open source java software to eliminate vendor dependency and return control back to in-house development teams. With open access to standard market risk components and java source code, firms can accelerate the time-to-market of their solutions.

Developers

Strata is aimed at quant or systems developers tasked with delivering analytic solutions into trading, risk, clearing or prime servicing, or collateral businesses. Strata empowers developers with vetted open source java components that deliver standard market risk functionality, allowing them to focus on the unique aspects of solutions delivery to their business stakeholders.